With growing concerns over energy security due to rising power demands and greater decarbonization targets, stationary fuel cells have garnered attention as alternative green power generation devices. The ability of fuel cells to operate using hydrogen, particularly green hydrogen, with high efficiency, makes them a unique contender for the renewable energy race. With various sectors aiming for decarbonization, which fuel cells will fit the mark, and which applications will be key to their success?

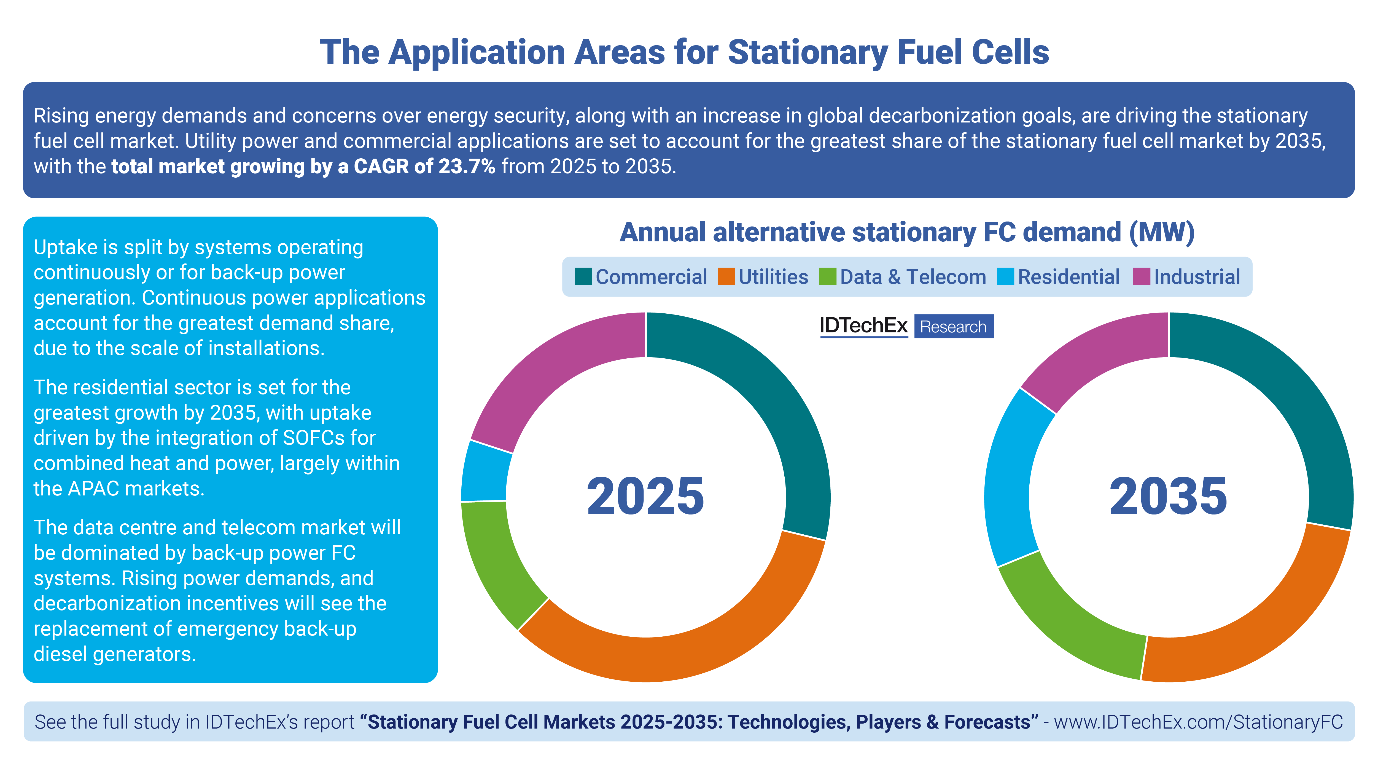

The new report from IDTechEx, “Stationary Fuel Cell Markets 2025-2035: Technologies, Players and Forecasts” provides a comprehensive overview of the stationary fuel cell market, including segmentation by fuel cell type, operating mode and application area. In-depth analysis of over 25 key market players, and benchmarking technologies, helps to provide granular 10-year forecasts for the entire stationary fuel cell demand and market value. IDTechEx predicts the stationary fuel cell market to grow by a CAGR of 23.7%, to US$8 billion by 2035.

The five main application areas for the stationary fuel cell market and their share of demand from 2025 to 2035. Source: IDTechEx.

The stationary fuel cell market can be segmented by the operating mode of the system, for continuous or backup power, with each FC design type better suited to a specific power generation mode. Additionally, each fuel cell type can be integrated for a different application area, including utilities, industrial, commercial, data centers & telecommunications and residential power generation.

Utilities applications refer to the direct supply of power to the grid. Systems generating heat can be integrated in local utilization for combined heat and power purposes, increasing the overall system efficiency. As power demand rises with growing populations, the development of countries and the continual digitalization and electrification of societies, there are increased strains placed upon the power grid. Two types of systems can be installed for grid power; backup power systems, designed for immediate power in the event of grid failure, and continual power systems, used to work in parallel with traditional utilities power generation technologies. Stationary fuel cells present an opportunity to provide energy security for growing grid power constraints, particularly for backup power generation. Global decarbonization targets help to fuel the uptake of fuel cells, however, they will compete with alternative larger-scale renewable power generation technologies like solar and wind power, along with long-duration battery energy storage.

Similar energy-intensive applications include data centers & telecommunications, which have seen attention due to the considerable rise in power demand with the emergence of artificial intelligence and cryptocurrency. Data centers & telecom networks require reliable and always on power, to ensure data is available when requested and when required, emergency network communication can be carried out. The IEA predicts data center power requirements to grow to over 1000 TWh by 2026 and so high-power generation systems which can meet these growing demands are required. The intensive thermal management required for data centers means that integration of high temperature SOFCs may be limited. Low temperature fuel cells present easier to manage cooling and quick ramp-up times, which is particularly suited for backup power generation and replacement of traditional diesel generators. Microsoft began exploring FC technology for data centers in 2013, initially focusing on SOFCs and in 2018 it switched its attention to PEM technology as a backup power alternative. Backup power for telecommunications networks present a market opportunity for stationary FCs with several companies exploring their potential uptake.

Both commercial and industrial applications are areas of opportunity for FCs, again for installing backup or continuous power generation. However, decarbonizing the industrial sector is challenging due to the high costs associated with low carbon alternatives and the long lifetimes required for industrial assets. Many industrial processes, including chemical refineries, operate at extremely high temperatures, require high power inputs, and generate greenhouse gases. IDTechEx sees the integration of fuel cells to act as carbon capture technologies as a potential commercial opportunity. Fuel Cell Energy in particular, are exploring the integration of its molten carbonate fuel cells for the sequestering of flue gas carbon dioxide emissions, along with power generation. These systems can also operate on alternative fuel supplies, an added incentive for their integration, whilst the hydrogen economy develops.

With limited access to hydrogen fuel, and the high costs associated, this hinders the widespread adoption of fuel cells for commercial applications. Fuel cells like direct methanol fuel cells (DMFCs), which operate on more widely accessible fuel, with a well-established global supply chain, have the potential to “fill the gap” whilst ramp-up of the hydrogen economy is ongoing. In general, current commercial adoption of stationary fuel cells is driven by companies looking to expand ESG portfolios and green credentials. IDTechEx finds that large corporations will drive the initial uptake of FCs for commercial and industrial applications with the available capital expenditure. Adoption is expected to become more widespread when installation price is reduced as economies of scale come into effect.

An area that has currently seen limited global adoption but provides a potential opportunity, is the residential sector. Residential applications typically refer to systems that can be operated in isolation to the grid for backup power generation, or for continual operation, mainly in remote areas or areas with grid instability. Systems operating in combined heat and power (CHP) modes are of particular interest to provide heat and power to homes. The systems need to be compact in size and operate with limited noise pollution. Operating with a variable fuel supply is also beneficial as access to hydrogen hubs is currently highly region dependent and drives up system operating costs. With this in mind, SOFCs have the greatest residential market to date and Japan is currently the largest residential market for CHP applications, with the country targeting the installation of 5.3 million FC units by 2030, accounting for 10% of households. Systems which can operate in conjunction with solar power and batteries have also garnered interest for remote, off-grid housing, particularly farms.

To find out more about the anticipated trends and the key and emerging market players, see the IDTechEx market report, www.IDTechEx.com/StationaryFC. Downloadable sample pages are also available.

For the full portfolio of energy and decarbonization market research available from IDTechEx, please visit www.IDTechEx.com/Research/Energy.